Content

Inventory management Grow your product-based business with an all-in-one-platform. Advanced accounting Scale smarter with profitability insights. I was using the free version, but I couldn’t find the ability to upgrade. So, if you don’t like QuickBooks Self-Employed, I’m not sure you can convert it to another version. This is one of those “I-can-hardly-believe-my-eyes” features that I mentioned earlier. I kind of love this feature and want it in QBO Essentials and Plus.

However, QBO might be too expensive or too difficult to use if you’re a sole proprietor. When you work for yourself, your top priority is ensuring that you’re balancing your budget every month. QBSE helps in this endeavor with tools for invoicing, collecting payments, and keeping track of expenses. Whereas QuickBooks Self-Employed caters specifically to freelancers and independent contractors, QuickBooks Online is more greatly designed for the small business owner. Therefore, whether you’re looking for additional features, scalability, or more affordable accounting software, there are certainly alternatives to consider. Additionally, you’ll be able to create rules for trending and predictable expenses or payments to help you automate data entry. Unfortunately, you can’t add a journal entry or new category since they are strictly Schedule C categories.

What’s The Scoop With Quickbooks Self

Without a reconciliation process, there’s no way to ensure every transaction has been accounted for and nothing is duplicated. Reconciling accounts is a monthly bookkeeping task you CANNOT do in Quickbooks Self Employed. You never know if there is a hiccup where something is skipped or gets entered twice because of your downloading transactions. You have no way of making sure the figures you are using to file taxes are accurate, resulting in you under or overpaying taxes. QuickBooks Self Employed also has a tab for taxes where it shows your quarterly and annual estimated taxes. This helps contractors ensure that they don’t fall behind in saving for and making their tax payments.

Is QuickBooks self employed the same as simple start?

If you want tax time to be very simple and easy and you are a freelancer, a solopreneur, or independent – use QuickBooks Self Employed. If you plan to hire employees – use QuickBooks Online Simple Start or QuickBooks Online Essentials.

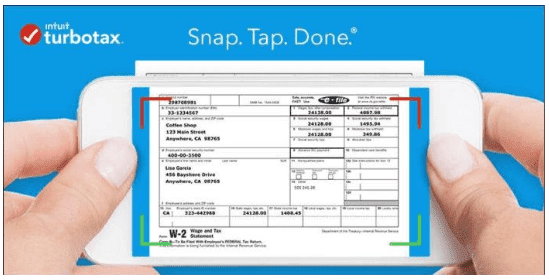

You may manage your subscriptions and auto-renewal may be turned off in Account Settings after purchase. Any unused portion of a free trial period will be forfeited after purchasing a subscription. QuickBooks Self-Employed is from Intuit, the maker of TurboTax, QuickBooks, and Mint. I am a musician quickbooks self employed and so I have to keep track of all of the lessons I have taught throughout the day, gig payments, invoices and expenses whilst staying away from home. You can also attach a receipt from a file on your computer, add a note, or exclude transactions (if, for example, it’s a duplicate).

Hardware & Software Requirements

As such, descriptions must be added from scratch for each invoice. But there also are widgets for Mileage and Estimated Taxes. “What, features I don’t even have in QBO? I can hardly believe my eyes.” Recently, a client asked to use QuickBooks Self-Employed . So far, I have steered clear of QBSE for a couple of reasons – I didn’t know it and it doesn’t fit most of my clients’ needs.

One of the most popular accounting software options on the market right now is QuickBooks Self-Employed. It offers basic accounting services which are important for freelancers. A common complaint of QuickBooks users, though, is that the program is difficult to use. Especially for those with little to no knowledge of accounting principles. QuickBooks Self-Employed allows those on the go, taking jobs here and there, to keep track of their income and tax implications of that self-employed income.

Quickbooks Banking

Most CPA’s will or should have a problem with a business not reconciling their bank or credit cards monthly. The problem is that if you don’t reconcile, there is the risk of errors or omitting a transaction from your books and your tax return. For the past 40 years I have always had my clients reconcile their accounts. Once I was told by my daughter that she reviews every transaction that is automatically downloaded from the bank, by way of a bank feed, the risk of manual error or omission is reduced.

- In any case, your invoicing provides a professional appearance and experience to your customers.

- We may receive compensation if you apply or shop through links in our content.

- Mileage data can’t be imported into a new QuickBooks account, so you would need to manually add each trip.

- For instance, those who provide contract services directly to clients will be best suited to QuickBooks Self-Employed.

- Intuit and other accounting software companies make plenty of products just for enterprise users that will better suit your needs.

- Wait, didn’t you just finish saying that QuickBooks is not a good choice?

- If your accounting needs are basic and you mostly need a way to get organized for tax time as a freelancer, QuickBooks Self Employed may suffice.

Some of that is because of tracking multiple businesses. But part of it is if I’m paying for a program to do certain things, I expect it to do at least those things. I can work around it and make it work, but I’m the kind that thinks nah, if I’m paying for it to do these things I shouldn’t have to do some elementary stuff. That one is a real problem when it comes to deductions if you are claiming anything based on the percentage of business miles .

Quickbooks Online Vs Quickbooks Self

Part of my complaint about data entry comes from being spoiled by other versions of hte program. The desktop program ins more intuitive about filling in information based on my description, etc. You can go through at the end of the year and manually add things up.

Software reps might push you to buy more sooner, but there is absolutely no reason to sign up for a higher subscription level than you think you need. Unless your business or industry has stringent security and compliance requirements necessitating local data storage, choosing QuickBooks Online over QuickBooks Pro is a no-brainer. This is especially true because QuickBooks’ desktop versions are being steadily phased out, with older versions not receiving any critical security updates since June 2021. QuickBooks Online is cheaper and comes with more features than QuickBooks Pro, the desktop version. Quickbooks Self Employed doesn’t get into all the different accounting type reports like Cash Flow reports or Balance Sheets. It’s just good to have a handle on what your actual costs are for your vehicle.

Manually Entering Transactions

When you are on the QuickBooks SE website, the live chat option sits in the right-hand corner of your screen. The wait time is usually short and the representatives are knowledgeable about the product.

Best Black Friday & Cyber Monday QuickBooks Deals (2021): QuickBooks 2021 Deals Summarized by Save Bubble – Business Wire

Best Black Friday & Cyber Monday QuickBooks Deals ( : QuickBooks 2021 Deals Summarized by Save Bubble.

Posted: Fri, 26 Nov 2021 08:00:00 GMT [source]

Everything is organized in tabs called Home, Transactions, Miles, Taxes, Reports, and Invoices. The reports available on the dashboard are profit and loss, expense tracking, accounts info, invoices, mileage, and estimated tax. When you open your dashboard, you’ll immediately be greeted with reports showing profit & loss, expenses, bank account balances, sales, and invoices. There’s also a search bar to find the feature/section you’re looking for and a settings cog you can use to customize your dashboard. QuickBooks Self-Employed is designed for business owners with simple business structures., i.e. no employees and/or contractors, no inventory, no need to record liabilities or equity transactions.

Small business owners who pay employees or contractors, who need to track accounts receivable, accounts payable, and view extensive reports about their business. PCMag.com is a leading authority on technology, delivering Labs-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology.

- I am a musician and so I have to keep track of all of the lessons I have taught throughout the day, gig payments, invoices and expenses whilst staying away from home.

- It will give you a list of transactions with the amount, category, date, and type of transaction.

- QuickBooks Self-Employed only provides P&L statements, while QuickBooks Online has more advanced reporting.

- Like the Small Business variant, QuickBooks Self-Employed has its own apps for Apple and Android.

- If QuickBooks Online is a better fit for your business, then wait until the beginning of the calendar year and start using QuickBooks Online as of the first of January.

- You can go through at the end of the year and manually add things up.

- Whether you see it as a pro or con, QuickBooks Self-Employed only offers two options for their pricing tiers.

The simple invoice is the client name and description of work and amount. QuickBooks Self-Employed only provides P&L statements, while QuickBooks Online has more advanced reporting. There is no balance sheet, no ability to track inventory, no ability to record or manage accounts receivable and accounts payable. I believe the aging reports for accounts receivable is missing and should be included. The omission of a balance sheet from QuickBooks Self-Employed generally may not be a problem if you are a sole proprietor and file a Schedule C with your personal income tax return. QuickBooks Self-Employed is suitable for people who work in the “shared economy”, are self-employed, file a Schedule C with their tax return, have no payroll. QuickBooks Self-Employed is not designed for businesses, with the exception of Single Member LLC’s, under certain circumstances.

End Of The Year Tax Checklist

QuickBooks Self Employed only allows you to categorize expenses as they come in. You CANNOT enter a bill and pay it later as you can in QuickBooks Online. Entering bills now to pay later creates an Accounts Payable. If you’d prefer to test out the software before you commit, you also have the option for a 30-day free trial. Keep in mind, though, if you opt for the free trial you will not be able to take advantage of the three-month discount. QuickBooks Self-Employed allows you to categorize your Schedule C entries.

- Intuit QuickBooks Self-Employed’s mobile app lacks little—if anything—found on the browser-based version.

- Intuit QuickBooks Self-Employed also doesn’t handle sales taxes.

- The Best QuickBooks Alternatives in 2022 We looked at a dozen of QuickBooks’ top competitors and ranked them by customer service…

- If the company were a person, it would just barely be a Millennial.

- To me, it seems that as long as you are using Mint, you will have to do your fair share of exporting and importing data, as it doesn’t integrate with other software.

Strong reporting, customizable invoices, inventory capabilities, and multiple currencies. This comment refers to an earlier version of this review and may be outdated. Since I don’t know whole lot about your business, I’m not sure I can give you a definitive answer about which way to go. But, that won’t keep me from trying so here are my general thoughts about the concerns you brought up. I now have a small S Corp doing strictly consulting for one company that I contract to, and basically no invoicing needed. You can also use Turbo Tax to download your current and previous tax records so long as you have paid for Turbo Tax this year. Since you are paying for and using QuickBooks Self-Employed with Turbo Tax, you should be able to follow these instructions to access records.

As a self-employed individual, you’re required to pay estimated taxes to the federal government each quarter. With that said, QuickBooks Self-Employed is a great place to start tracking income and expense. And, if the company grows, so too will its need for more QBO. There is one quick work-around you can use at tax time to make sure you don’t overpay. Use the expense numbers in your QuickBooks for Etsy account, but don’t use the Income numbers.

How do I link QuickBooks to HMRC?

In QuickBooks, go to the Advanced section under Account and settings, select Learn how to connect. Let’s go, this will take you to the HMRC page. Once you have read the guidelines, select Continue.

At the top of this report, you can quickly see your business income, spending, and business profit. Below it, you’ll see a running log of all of the transactions related to your business. Transactions can be filtered by type, account, and date range. You’ll see in which category each expense falls, and update the categories if necessary. In addition, you can add new accounts here, search, or even add transactions manually.