Current assets are all assets that can be reasonably converted to cash within one year. In those rare cases where the operating cycle of a business is longer than one year, a current liability is defined as being payable within the term of the operating cycle.

A freelance social media marketer is required by her state to collect sales tax on each invoice she sends to her clients. It’s still a liability because that money needs to be sent to the state at the end of the month. All businesses have liabilities, except those who operate solely operate http://makehous.com/?p=19626 with cash. By operating with cash, you’d need to both pay with and accept it—either with physical cash or through your business checking account. Any type of borrowing from persons or banks for improving a business or personal income that is payable in the current or long term.

Accounting Reporting of Liabilities

Since most companies do not pay for goods and services as they are acquired, AP is equivalent to a stack of bills waiting to be paid. For example, if a company has more expenses than revenues for the past three years, it may signal weak financial stability because it has been losing money for those years. However, if a company’s normal operating cycle is longer than one year, current liabilities are the obligations that will be due within the operating cycle. Non-Current liabilities are the obligations of a company that are supposed to be paid or settled in a long term basis generally more than a year. Accounts payable –These are payables to suppliers respect to the invoices raised when goods or services are utilized by the company.

These different examples of current liabilities for companies and for individuals show the breadth of liability which could be the obligation of a company or individual. The offsetting debit is to the interest expense account, and indicates the amount of interest expense accrued by a business, but not yet billed to it by a lender. A variation on this concept is a customer prepayments account, or a customer deposits account.

Bookkeeping for expenses

This is current assets minus inventory, divided by current liabilities. A monetary item is an asset or liability carrying a fixed numerical value in dollars that will not change in the future. Accrued Expenses – These are the expense i.e. the salaries which are payable to the employees in the future. Liability is an obligation, that is legal to pay like debt or the money to pay for the services or the goods utilized. For example, you may pay for a lease on office space, or utilities, or phones.

In the case of liabilities, the “other” tag can refer to things like intercompany borrowings and sales taxes. Because payment is due within a year, investors and analysts are keen to ascertain that a company has enough cash on its books to cover its short-term liabilities. Total liabilities online bookkeeping are the combined debts that an individual or company owes. Liabilities can be described as an obligation between one party and another that has not yet been completed or paid for. They are settled over time through the transfer of economic benefits, including money, goods, or services.

An expense report is a form of document that contains all the expenses that an individual has incurred as a result of the business operation. For example, if the owner of a business travels to another location for a meeting, the cost of travel, the meals, and all other expenses that he/she has incurred may be added to the expense report.

Cash flow

What is liability in accounting with examples?

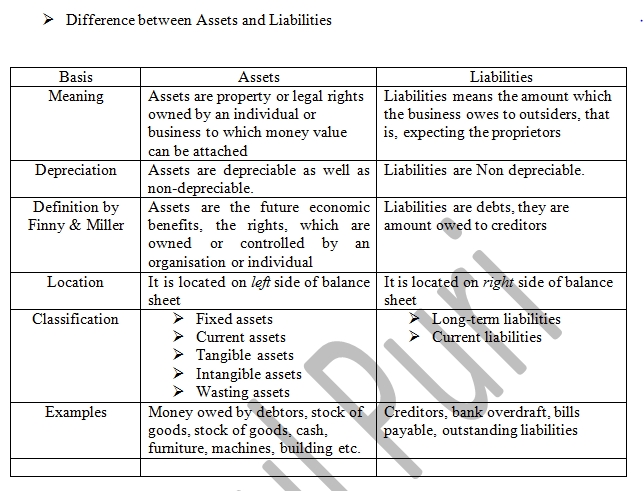

Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Examples of liability accounts reported on a company’s balance sheet include: Notes Payable. Accounts Payable. Salaries Payable.

If you stop paying an expense, the service goes away or space must be vacated. An expense what is a liability in accounting is an ongoing payment for something that has no tangible value, or for services.

The classification is critical to the company’s management of its financial obligations. A debit either increases an asset or decreases a liability; a credit either decreases an asset or increases a liability. According to the principle of double-entry, every financial transaction corresponds to both a debit and a credit. Note that a long-term loan’s balance is separated out from the payments that need to be made on it in the current year.

- A good example is a large technology company that has released what it considered to be a world-changing product line, only to see it flop when it hit the market.

- It must be ordinary and necessary (Welch v. Helvering defines this as necessary for the development of the business at least in that they were appropriate and helpful).

- They can include payroll expenses, rent, and accounts payable (AP), money owed by a company to its customers.

How to Calculate Average Current Liabilities?

What are common liabilities?

There are three primary types of liabilities: current, non-current, and contingent liabilities. Liabilities are legal obligations or debt. Capital stack ranks the priority of different sources of financing.

Consequently, these expenses will be considered business expenses and are tax deductible. In isolation, total liabilities serve little purpose, other than to potentially compare how a company’s obligations stack up against a competitor operating in the same sector. Investors can discover what a company’s other liabilities are by checking out the footnotes in its financial statements. When something in financial statements is referred to as “other” it typically means that it is unusual, does not fit into major categories and is considered to be relatively minor.

Essentially, it means that the company “underpays” the taxes in the current period and will “overpay” the taxes at some point in the future. Long-term liabilities can be a source of financing, as well as refer to amounts that arise from business operations. For example, bonds or mortgages can be used to finance the company’s projects that require a large amount of financing.

Liabilities are critical to understanding the overall liquidity and capital structure of normal balance a company. The primary classification of liabilities is according to their due date.

The operating cycle is the time period required for a business to acquire inventory, sell it, and convert the sale into cash. Trade working capital is the difference between current assets and current liabilities directly associated with everyday business operations. An accounts payable subsidiary ledger shows the transaction history and amounts owed for each supplier from whom a business buys on credit. AP typically carries the largest balances, as they encompass the day-to-day operations. AP can include services,raw materials, office supplies, or any other categories of products and services where no promissory note is issued.

Businesses can measure the amount of debt (liabilities) against two other measures, to determine if the business has too much debt/liability. The concept of leverage for a business refers to how a business acquires new assets. If the assets are acquired by borrowing, through loans, it increases liabilities. They arise from the difference between the recognized tax amount and the actual tax amount paid to the authorities.

Spotting Creative Accounting on the Balance Sheet

Three examples of contingent liabilities include warranty of a company’s products, the guarantee of another party’s loan, and lawsuits filed against a company. Because they are dependent upon some future event retained earnings balance sheet occurring or not occurring, they may or may not become actual liabilities. To see how various liability accounts are placed within these classifications, click here to view the sample balance sheet in Part 4.