To recognize prepaid expenses that become actual expenses, use adjusting entries. On the other hand, liabilities, equity, and revenue are increased by credits and decreased by debits. Assets and expenses are increased by debits and decreased by credits. When a person gives something to the organization, it becomes an inflow and therefore the person must be credit in the books of accounts.

Accrued Expense Definition

Similarly when you credit what goes out, you are reducing the account balance when a tangible asset https://accountingcoaching.online/ goes out of the organization. If a long‐term note payable of $10,000 carries an annual interest rate of 12%, then $1,200 in interest expense accrues each year. At the close of each month, therefore, the company makes an adjusting entry to increase (debit) interest expense for $100 and to increase (credit) interest payable for $100.

After delivery, the seller claims the same funds as revenue earnings. First, how accountants define Accrued Accrued expenses Expense, along with similar terms such as Deferred Payment, Accrued Assets, and Accrued Liabillities.

Accrual Accounting Vs. Cash Basis Accounting

Another advantage is that the users of the financial statement can see all the obligations of the business along with the dates on which it will become due. Under the cash basis of accounting, the full extent of such transactions is not entirely clear. In short, this journal entry recognized in the financial statements enhances the accuracy of the statements. The expense matches the revenue with which it is associated. Patriot’s online accounting software is easy-to-use and made for the non-accountant.

Equity is of utmost importance to the business owner because it is the owner’s financial share of the company – or that portion of the total assets of the company that the owner fully owns. Equity may be in assets such as buildings and equipment, or cash. The presence of over accruals can be avoided by only making an accrual entry when the amount to be recorded is easily calculated. If the amount is subject to fluctuation, the most conservative figure should be recorded. Most firms organize regular company events – business meals aren’t a rarity either.

The Difference Between Accrued Expenses And Accounts Payable

As you use the prepaid item, decrease your Prepaid Expense account and increase your actual Expense account. To do this, debit your Expense account and credit your Prepaid Expense account. Before diving into the wonderful world of journal entries, you need to understand Accrued expenses how each main account is affected by debits and credits. Create a prepaid expenses journal entry in your books at the time of purchase, before using the good or service. Thus when you debit what comes in, you are adding to the existing account balance.

How do you determine accrued expenses?

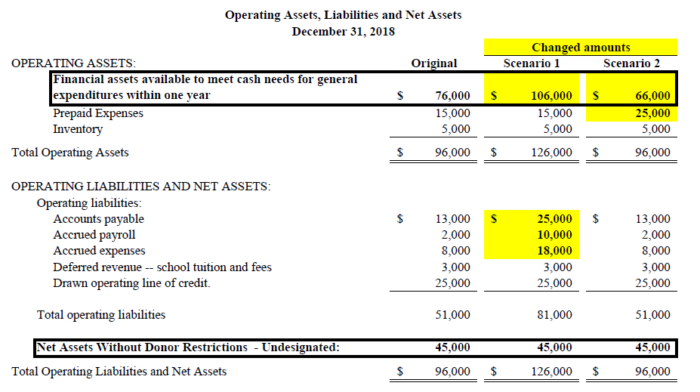

Accounts payable are recognized on the balance sheet when the company buys goods https://accountingcoaching.online/payroll-accounting/payroll-accounting-with-payroll-journal-entry/ or services on credit. Accrued expenses are realized on the balance sheet at the end of a company’s accounting period when they are recognized by adjusting journal entries in the company’s ledger.

The value of the asset is then replaced with an actual expense recorded on the income statement. You accrue a prepaid expense when you pay for something that you will receive in the near future.

For an expense to be recognized under the matching principle, it must be both incurred and offset against recognized revenues. The accounting method the business uses determines when an expense is recognized. Accruals improve the quality of information on financial statements by adding useful information about short-term credit extended to customers and upcoming liabilities owed to lenders. Accruals are needed for any revenue earned or expense incurred, for which cash has not yet been exchanged. DateAccountNotesDebitCreditX/XX/XXXXPrepaid Expense9000Cash9000As each month passes, adjust the accounts by the amount of rent you use.

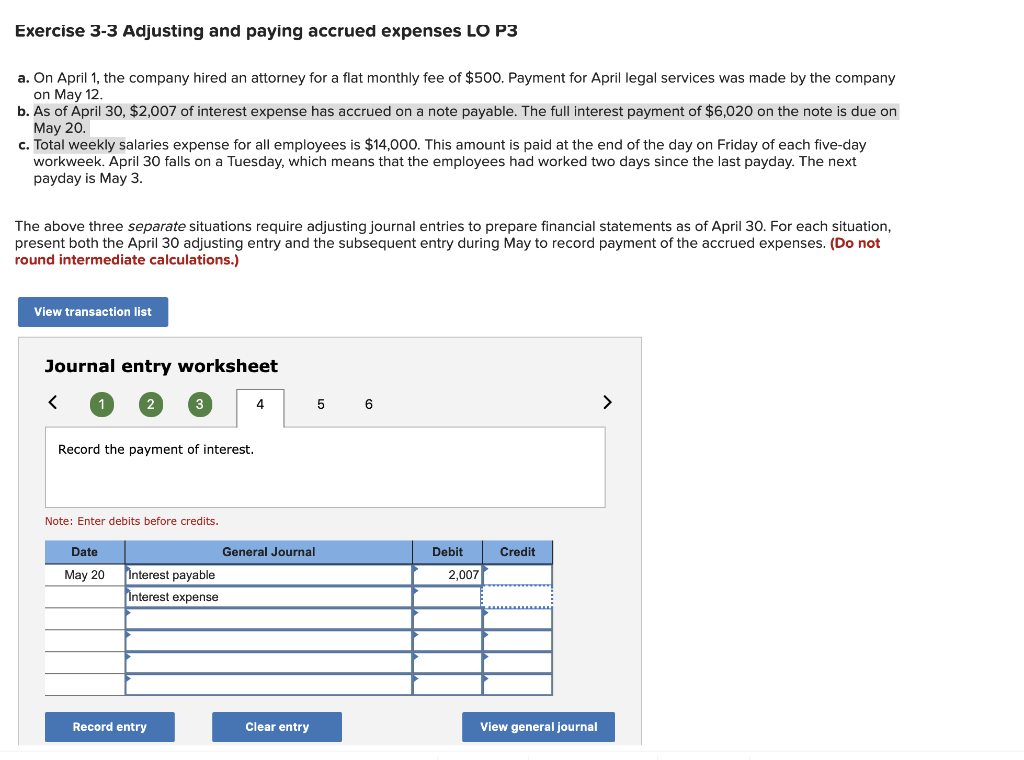

Accrual accounting is built on a timing and matching principle. When you pay the amount due, you reverse the original entry. Once an accrued expense receives an invoice, the amount is moved into accounts payable.

- Accrual accounts include, among many others, accounts payable, accounts receivable, accrued tax liabilities, and accrued interest earned or payable.

- For example, wages that have been earned but not paid should be recorded as accrued expenses.

- Accrued expenses are those you’ve incurred but not yet paid for, and you need to record these on your balance sheet.

Since the prepayment is for six months, divide the total cost by six ($9,000 / 6). DateAccountNotesDebitCreditX/XX/XXXXPrepaid Expense1800Cash1800Each Accrued expenses month, adjust the accounts by the amount of the policy you use. Since the policy lasts one year, divide the total cost of $1,800 by 12.

An accrued dividend is a liability that accounts for dividends on common or preferred stock that has been declared but not yet paid to shareholders. In this case, you credit the cash account because you paid the expense with cash. To reverse the transaction, debit the accrued liability account. Credit $31,000 to “Wages Payable” (this would show up under “Short Term Liabilities” on the balance sheet). Here is an example of when an expense should be accrued or when it should fall under accounts payable.

What is accrued salary?

Accrued salaries refers to the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them. This information is used to determine the residual compensation liability of a business as of a specific point in time.

Accrued Expenses & Revenues: Definition & Examples

Accrued salaries refers to Permanent Accounts the amount of liability remaining at the end of a reporting period for salaries that have been earned by employees but not yet paid to them. This information is used to determine the residual compensation liability of a business as of a specific point in time. Accounts payable is an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers.

Accrued Expenses And Revenues Definition

Usually, an accrued expense journal entry is a debit to an expense account. In the above example, everything but accounts payable are . Accrued expenses (accrued liabilities) along with the other prepayment and deferred payment situations described above are used in accrual accounting but not cash basis accounting. The company may owe its own employees salaries and wages for work performed, but not yet paid.

For example, assume a reseller receives goods from a supplier that it is able to immediately resell. However, the billing for those goods does not require payment for another month. Since the supplier delivered the goods and the reseller already generated revenues from the sale of those goods, it must recognize the associated expense. So the associated expense must be listed as a liability to be paid at some point in the future.

DateAccountNotesDebitCreditX/XX/XXXXExpenseXPrepaid ExpenseXLet’s say you prepay six month’s worth of rent, which adds up to $6,000. When you prepay rent, you record the entire $6,000 as an asset on the balance sheet. Each month, you reduce the asset account by the portion you use. You decrease the asset account by $1,000 ($6,000 / 6 months) and record the expense of $1,000.

Is An Accrued Expense A Debit Or Credit?

Income accounts are temporary or nominal accounts because their balance is reset to zero at the beginner of each new accounting period, usually a fiscal year. If the Cash basis accounting method is used, the revenue is not realized until the invoice is paid. Income is “realized” differently depending on the accounting method used. When a business uses the Accrual basis accounting method, the revenue is counted as soon as an invoice is entered into the accounting system.