If you’re against several loan and you can mastercard rejections due to the lowest CIBIL get regarding 590 and wish to boost your own rating to help you 750, don’t worry as there are many ways adjust it. Once we discuss the CIBIL rating, there are a great number of activities which go to the one another growing or coming down they. Pretty much every bank monitors your credit rating in advance of providing you one form of financing. A reduced rating shows that you’re not decent from the dealing with your financial situation and possess irresponsible investing patterns. However, as you should best the individuals patterns today and require to create a get out-of 750, don’t be concerned as we might possibly be telling you on a number of the amazing a method to do the exact same.

Procedures You ought to Contemplate to improve Your own Score

You will get a review of some of the helpful measures that may make it easier to improve your CIBIL get to 750 of the lower get out of 590 right now. You need to remain all of them at heart to ensure that it can be done slowly.

Punctual Statement Payments

This is basically the first issue you have to do in order to increase your credit rating. A primary reason browse around this web-site which you have a great CIBIL score away from 590 is that you may has actually skipped several costs. It fundamentally goes just like the handmade cards offer the choice to buy today and you can shell out later. Due to this fact, a good amount of somebody spend past its repayment capabilities and you will falter to really make the payment on deadline. Next few days, the balance goes highest on account of later percentage charge, fees or any other costs involved. There might be weird payment delays and you may non-payments because of excessive credit cards. If you’re one against such as for example difficulty, discover the provider easily more the fresh new score goes next down from 590. Make use of deals or reduce your usual spending’s to pay off their the costs earliest. After that, you should purchase considering your payment features while making your expenses payments promptly if they was credit card bills otherwise electric bills. Sure, your utility bill payments as well as reflect on the credit report and you will connect with your credit score.

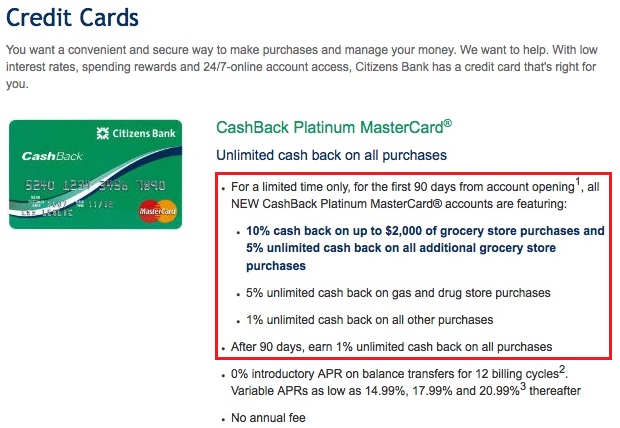

Utilise Your own Credit card Meticulously

If you are an individual who believes for the evaluation the latest limitations, your own charge card is not a perfect promotion for it. When you decide to take out a top portion of your borrowing limit as the obligations, lenders see you due to the fact a credit starving borrower. They perceive so it because taking personal debt over what you can repay and that has an effect on your credit rating significantly. Therefore, it is critical to make use of credit card wisely and rehearse simply 30% in order to 40% of borrowing limit every month. In that way, you will also be able to shell out their bills punctually along with your credit history commonly visited 750 throughout the years.

Say No’ to Minimum Due Commission

The majority of people believe that they are able to log on to that have the financial conclusion by paying simply its lowest due matter with the credit cards expenses. We like to tell you so it has an effect on your credit rating heavily. In accordance with a score off 590, it would be likely that you truly must be this also. Minimal due is generally the five% of the overall costs number. After you ount, the attention or any other charges add up toward remaining count and you can reflect in the next charging you course.

By doing this consistently, your ount and very quickly, it amount will additionally be so high that you will not getting in a position to pay this. That’s why, always try to pay your total charge card statement amount, and for that it, you’ll have to manage your spending habits and place a beneficial avoid toward a lot of shoppings. Paying expense completely as well as on time is a sign of a good credit score choices.

Stop Debt settlement

If you think that your credit score are going to be increased to help you a score out of 750 by the paying your dated obligations together with your financial then we need to let you know that this doesn’t occurs. By making money on the loans, you ount but it often think about your credit report as the Loans Compensated. For that reason, you may want to deal with complications into the accessing fresh credits. It might be healthier to end whichever debt relief with your bank to begin afresh. You can pay all the personal credit card debt by choosing a personal bank loan from the a lower rate of interest. The low rates commonly end in lesser monthly payments, letting you shell out your debts on time. All that will help you enhance your credit rating so you’re able to 750 over the years.

Check your CIBIL Declaration Daily

Your own CIBIL statement holds every economic deals created by you instance bank card costs, EMI costs, power bills while others. Either, what will happen is due to specific dissimilarities on your label , time regarding beginning, email id, and you can Pan, your credit rating will get influenced. Thus, it is essential to take a look at statement more than often thus to report to the credit agency and then make him or her fix-it. Incorrectness on the CIBIL statement can also affect the CIBIL score, as soon as might rectify them, their score commonly increase.